What developers need to know about economic development incentives

Real estate developers, like many, are facing delays and increased costs associated with their development projects. Have you considered applying for economic development incentives to bolster your capital stack?

Disruptions caused by the coronavirus pandemic have led real estate developers, like many companies, to face delays and increased costs associated with their development projects. One solution is to consider applying for economic development incentives to help fill the gap in your capital stack.

What are economic development incentives?

Municipal economic development incentive programs provide various forms of financial and nonfinancial support to help promote real estate projects and business growth. Federal, state, or local levels of government each offer its own set of programs, which may include grants, subsidized loans, and property tax credits.

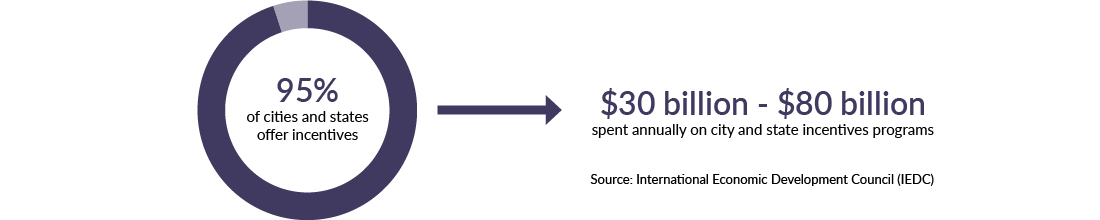

According to the International Economic Development Council (IEDC), incentives are a common tool used in economic development. About 95% of U.S. cities and states offer at least one incentive for economic development, and they spend an estimated $30 billion to $80 billion annually on these programs. More is spent on incentives than on all other economic development programs combined, with some states allocating as much as 50% of their budgets on incentives. Federal spending on incentive programs vary. The National Trust for Historic Preservation estimates $27.5 billion in tax credits were provided over the more than 30-year life of the program. The New Markets Tax Credit (NMTC) was established in 2000, and since 2003, the program credited more than $27 billion to applicates.

What kinds of incentives programs are available?

Incentives programs range from loans to property tax abatements, and a variety of projects can qualify. Many local incentives will be community revitalization programs (CRPs) such as brownfield programs and renovations to obsolete buildings. However, they can also support rehabilitation of historic buildings, small business formation, affordable housing development, and job creation.

The federal government also offers the following incentive programs:

- Historic tax credits

- Opportunity zones

- New market tax credits (NMTC)

- Alternative financing (for example, Property Assessed Clean Energy)

What are the benefits of economic development incentives?

Developers should consider incentives for a variety of reasons. Incentives are an important mechanism for developers to “fill gaps” in the capital stack caused by development impediments that raise costs. With higher construction costs, debt service obligations are commensurately higher due to needs for additional upfront capital. To make up for these increased costs, a developer may increase projected revenue by attempting to raise rental rates above what the market currently supports. However, the market will ultimately dictate a ceiling on rates, regardless of what revenue projections might say.

This is where incentives can help. For instance, property tax abatements can help reduce annual operating expenses, which frees up cash flow available to support debt service obligations and meet required return thresholds. In this way, incentives play a supporting role in financing procurement, maintaining affordability for end users, and accessing important state funding.

Typically, incentive funds may be offered either upfront or over time as an annual cash flow to improve performance over the life of the asset, depending on the program and its goals. It is important to note that most of these programs are for finite time periods. The project will eventually need to be able to support its full burden.

Incentives play a supporting role in financing procurement, maintaining affordability for end users, and accessing important state funding.

Particularly for real estate with the potential to advance community goals, municipalities also reap benefits. Incentivizing development projects serves to expand the tax base, increase property values, add amenities that improve the quality of life and provide long-term benefits to the community, and advance other important public policy goals.

For example, Fiat Chrysler Automotive received a $319 million incentives package for $4.5 billion in investments at five manufacturing sites in Southeast Michigan. In return, the company agreed to create 6,433 new jobs across multiple plants. It also agreed, as part of the automaker's Community Benefits Agreement with the city of Detroit, to fund grants for local home repairs near one of the new plants.

Larger projects that are awarded the incentives can also have a ripple effect in the community’s development, generating smaller projects nearby. These spin-off projects give the tax incentives a better return on investment because they are generating additional revenues through economic activity (taxes, consumer spending, etc.).

How do real estate developers apply for incentives?

Understanding the complex structure and application process required for each incentive program can be a major challenge because incentives require specialized attention, experience, and relationships for successful execution.

Your first step will be to identify the programs that fit your project and goals. This is a discussion that requires a nuanced understanding of the programs available at every level of government, their application processes, their requirements, and their value to your project over time.

Municipal incentives often improve the feasibility of complex real estate projects.

States each have different criteria per grant or incentive and per asset class. Many incentives are needs-based. You will need prove the incentives are essential to meeting your return thresholds. This matchmaking process is just the start of a long road to procurement, which involves articulating your needs to the right municipal leaders throughout the process and evaluating which program and project type is likely to have the most beneficial effect on property taxes.

Municipal incentives often improve the feasibility of complex real estate projects, and they’re well worth the time to consider. Our team offers the expertise you need to understand the available incentive programs at the local, state, and federal level. We can help you maximize incentives to make projects feasible and achieve desired return-on-investment targets. Contact our team today to explore your options.

In the meantime, if you liked this article, consider signing up for our email newsletter to get other articles just like it sent to your inbox.

This article was adapted from an unpublished research report on development and incentive trends. Sources include:

- Area Development. Understanding Economic Development Incentives in Site Selection.

- Crain’s Detroit Business. State, city approve FCA incentives packages, land swap totaling $319 million.